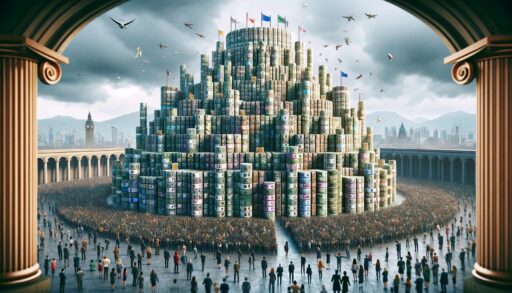

Against the backdrop of glittering unemployment figures and the U.S. economy generating 303,000 jobs in March, one may be tempted to proclaim economic buoyancy. Yet, this rosy interpretation belies a structural morass primarily rooted in the relentless growth of debt within Western financial systems.

As an ardent proponent of Austrian Economics, it is critical to recognize that the superficial health of the labor market does not mitigate the underlying perils of runaway debt. Gold’s price oscillation around $2,300, while of interest, represents more than a mere investment trend—it underscores investors’ search for a haven from inflationary pressures and currency degradation.

Short-Term Macroeconomic Trends

Job growth and a marginally stronger dollar are transient developments in an otherwise debt-laden narrative. Central banks, trapped in the orthodoxy of Keynesian stimuli, are unlikely to discontinue quantitative easing or artificially elevate asset prices despite persistent inflation concerns.

As reflected by indexes like the Dow Jones Commodity Index, commodities exhibit signs of resilience, pointing toward investors hedging against future inflation and currency devaluations. While insightful, the fixation on the S&P 500 and other equity performance metrics often becomes a distraction from the elemental problems—overleveraged public finances and consumer debt reaching new pinnacles, as evidenced by data from various consumer credit reports.

Long-Term Predictions and Austrian Prescriptions

In the long run, if policy frameworks do not rebalance towards fiscal conservatism—accentuating spending cuts, debt repayment, and monetary reform—we are likely bound for an economic crisis more enervating than the any previous. Do not be deceived our situation is dire. The potential collapse is not merely fiscal; it may be systemic, challenging the very tenets of current monetary policy.

Should You Invest In Junk Silver?

The market segments that could witness significant volatility include housing, where signals are already flashing with supply surges. Central to the Austrian critique is the misallocation of resources birthed from artificially low interest rates, evident now in real estate valuations which are disconnected from economic reality.

The Path to Financial Rectitude

Several steps must be taken to forestall the dire predictions. First, policy must shift toward sound money—a return to competitive currencies or a gold standard could act as a bulwark against hyperinflation. Second, central banking functions should be significantly curtailed, with a push for fractional-reserve banking to be restricted, if not wholly dismantled and forever banned.

Disregarding these monetary and fiscal warnings, the lurch toward insolvency is inescapable. The economic health of markets is far more vulnerable than job statistics and stock market exuberance would have us believe.

Is The Gold To Silver Ratio Signaling Silver Is On Sale?

In sum, the dance upon the precipice of fiscal catastrophe continues. As debt escalations go unchecked and central banks persist with their intemperate policies, the illusionary market highs must be viewed through the lens of economic reality. Without prudent action, the specter of a debt-induced economic downturn looms ominously. It is time for a calculated, Austrian-inspired return to financial prudence—a call to resurrect suppressed economic liberties and the sanctity of sound, uncompromised currency.

Be not deceived – be prepared ~ Silver Savior

* Note We are not giving advice, only our opinion, We are not a financial advisor. This article represents our thoughts about the economy only. Do your own due diligence – think for yourself.