What Are You Waiting For?

If the US dollar’s global supremacy erodes, America will face a reckoning like none before. – Fareed Zakaria – CNN/WaPo

BofA Sees Risk of Another FX Liquidity Crunch After Bank Crisis

The global currency market is vulnerable to a liquidity crunch later this year as financial conditions tighten and economic growth slows, Bank of America Corp. warned.

[…]Left unattended, these threats could reverse decades of efforts to reduce poverty and fast-track development, while setting the stage for a “lost decade.” – World Bank Report

The World Bank isn’t the first to warn about converging factors that are difficult to address and threaten to radically alter the global economy.

The recent banking crisis brought home in a big way the role bonds play in keeping credit flowing throughout the system, supporting companies, governments, and economies. Any kinks in the overall system can lead to a crisis in confidence that exposes other weak links and can quickly threaten to derail the financial system, as we saw in the recent failures of Silicon Valley Bank and Signature Bank SBNY and the forced sale of Credit Suisse CS.

‘The Fed hasn’t signaled that they’re done,’ strategist says

… we’re not exactly sure if we’re going to have a pause, perhaps another rate hike higher than the 25 basis points

I begin this article with a quick look at some of the news – much of which is propaganda being delivered to the people as preparation for the deliberately caused fall of the United States and the standard revolutionary tactics that will be used to usher in the New World Order.

I wanted to speak . . . about the new world taking shape around us, about the prospects for a new world order now within our reach. . . . The new world order really is a tool for addressing a new world of possibilities. -George H. W. Bush

The headlines depict a nation and world in which persistent financial problems, an unexpected Pandemic, and continuing climate problems have led to the situation today.

Lest you forget, these components were deliberately created and deployed using deception, authority worship, and pretended science. Each contributed to the West’s imminent downfall and the soon-to-be-revealed New World Order.

The one thing man fears is the unknown. When presented with this scenario, individual rights will be willingly relinquished for the guarantee of their well-being granted to them by a World Government, a New World Order. – Henry Kissinger

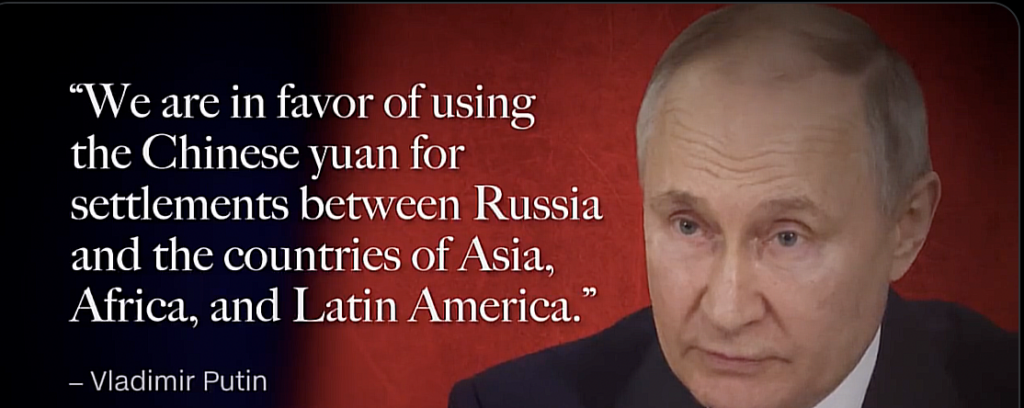

The die is cast – America’s dominance as the supreme superpower issuing the world’s world reserve currency with the world’s largest, most productive economy is ending. The plan that began after the Federal Reserve Act passed (1913) under suspicious circumstances has reached its goal, and – the time has come to finally destroy the USA, relegating it to a backwater colony of a blossoming New World Order.

Most of you reading this have yet to see what is happening even though it’s clear, visible, and easily understandable, many if not most, have invested too much in the soon-to-be-gone American financial system and our current way of life to allow themselves to face the truth.

Drastic changes are in store for Americans, and we have yet to be asked or even given notice, but I am giving you notice (again) here in this article.

[The New World Order] cannot happen without U.S. participation, as we are the most significant single component. Yes, there will be a New World Order, and it will force the United States to change it’s perceptions. – Henry Kissinger

Feudalism The Final Solution

Like the other nations, America is not an independent, sovereign country – existing standalone and guided by its people’s goals, plans, aspirations, hopes, and dreams. It is no longer a nation driven by excellence, productivity, and abundance derived from a wealth of moral superiority and the aggregation of individuals free to grow as a means to their own ends.

America is a mercenary slave colony managed by wealthy foreign usurpers who remain out of sight while promoting infiltrators into all positions of power and prominence in the Federal and State governments.

Question: Should it be lawful for people with dual citizenship to hold positions of great power in the United States?

It is those overlords, those that control through bribery, blackmail, corruption, and deadly force, that have decided America will lose its status in this world, and through plunder and organized criminal wealth transfer (financial collapse), the American middle class will be destroyed financially.

A nation without a middle class will soon become a feudal society.

Feudalism is the final solution; lords to rule and vassals to toil. Feudalism has existed on and off throughout the history of humankind. It is the preferred state for plutocrats who live only to control people – their idea of safety is humanity in a mask toiling six feet apart, all enclosed behind a fence usually called a country.

Digital Currency In A Cashless Society: The New Country.

I have written about the dangers of the much-discussed Central Bank Digital Currency (CBDC). The CBDC is an option proposed by central bankers as a replacement for cash (paper dollars). Please see my last three articles for more information about CBDC.

Paper dollars will be called the cause of the great financial collapse of 2023.

However, paper dollars alone are not the cause of any problem. It is only a monetary system issuing paper dollars that must be borrowed into existence that can be blamed for the convenient destruction of purchasing power (inflation) we are now witnessing.

But it is important to understand that paper currency is essential to financial privacy and an individual’s autonomy. These handheld chits facilitate private transactions, requiring no additional electronics or hardware; they are light, easy to carry, and well-understood by almost everyone on Earth.

As In 1913 – So In 2023

As I discussed in my last article, it was necessary to deceive Americans into authorizing another US central bank. To pull this off, bankers created a series of financial panics and collapses, culminating in the 1907 bank runs, failures, and a stock market collapse.

After the subsequent wealth transfer, losses, and hardships caused by the panic, the bankers created two pieces of legislation that were promoted as providing safety in banking and would permanently end bank runs and eliminate financial panics. The bills were referred to as the Aldrich plan and the Federal Reserve Act.

Problem Reaction Solution

To create the necessary dialectic, the two bills were dissimilar. The Aldrich bill was configured so that the government and bankers figured largely in the implementation. The Aldrich bill was then publicly criticized for its lack of oversight and potential for creating a central bank that would be overly powerful and not accountable to the government or the public.

The Federal Reserve bill, however, addressed these concerns by creating a Federal Reserve Board, which would be appointed by the President and could be removed from office. This gave some measure of oversight and accountability that the Aldridge bill did not have.

Since Americans were generally suspicious of bankers and central banks, it was necessary to produce an option to the Aldrich bill that symbolically implied you had a choice – but only those two choices.

The Aldrich bill produced a problem of bankers controlling the central bank, and the people were against this bill. So, the Federal Reserve Act pretended that it would be more under the control of the people and included oversight and accountability – of course, none of that was true at all.

The people had spoken, and the Federal Reserve Act was deviously and likely unlawfully passed when congress had already recessed for Christmas in 1913.

Ghosts of Central Banks Past

My administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC,” the executive order reads, adding that the development should align with “democratic values, including privacy protections. – Joe Biden

Like in 1913, we will be offered the Central Bank Digital Currency to replace the paper dollar and traditional banking. But like 1913, the CBDC is already heavily criticized, and the Fed has other technologies that might replace CBDC with similar technology.

These include the FEDNOW payment system, the Fedwire Funds Service, and the FedAccounts service. The FEDNOW payment system is a real-time payment service the Federal Reserve provides. The Fedwire Funds Service is a secure, reliable, and cost-effective funds transfer service offered by the Federal Reserve. The FedAccounts service is a digital banking platform enabling users to open Federal Reserve Bank accounts.

The FedAccounts technology is most similar to the CBDC and may be the contender used in the two-choice scenario as seen in 1913; however, be on the lookout for an unexpected contender that might be just right for the people.

Legislation from numerous sources has been introduced to prevent CBDC and its offshoots. Among others, S. 3954 and HR 6415 would prevent the Fed from offering products or services directly to an individual, maintaining an account on behalf of an individual, or issuing CBDC accounts or currency to an individual.

Also, several states have already passed legislation or are working on bills prohibiting CBDC participation in these states.

Bank Consolidation

People are one of many parties that will be harmed by implementing a central bank digital currency. Thousands of banks in the United States will be affected, and many will be forced to close. Small local banks and credit unions will no longer be part of the new system, as individuals will no longer need accounts held locally.

As a result, banks have sponsored legislation preventing central banks from creating a new financial model based on digital currency and centralized accounts. See the two bills above, both introduced by a coalition of local banks.

To facilitate introducing and adopting some form of CBDC, I believe central bankers will use inflation and rising interest rates to destabilize more banks like SVB. At the same time, rating agencies will remain active in publicizing the names of banks with weakening or insolvent balance sheets.

As we approach the fall of 2023, large numbers of small and medium-sized independent banks will have been wiped out; their assets cannibalized by the large megabanks, which will later be part of the central bank digital currency system.

“Shark Tank” investor Kevin O’Leary said the start of the demise of regional banks is underway. Eventually, the banking sector will become an “oligopoly” of very large institutions.

Market Summary

Inflation Continues To Rise

Inflation is a symptom of a debt-based currency system reaching its end of life. Debt, the only product of central banks, increases to the point where the number of dollars in the system relative to a declining level of products available results in a single dollar’s drastically falling purchasing power. In conjunction with rising interest rates, this problem creates liquidity problems as interest payments sidetrack mainstream commerces’ access to cash. This is a terminal situation since neither central bankers nor the government intends to curtail spending or lower interest rates.

For real information regarding financial data points, such as inflation, money supply, unemployment rates etc., I recommend ShadowStats.com. According to the latest Shadow Stats:

…but inflation pressures continue to mount, with an extraordinary systemic flight to liquidity, still holding at a 52-year high.

As previously reviewed, the March Federal Open Market Committee (FOMC) raised its targeted Fed-Funds Rate by a minimal 0.25%, to 5.00%, citing hopes that the Banking-System Crisis would dampen the Economy and the FOMC-driven Inflation. Yet, with the new Fed Funds Rate at a 15-plus-year high (since July 2007), the earlier FOMC rate hikes already are pummeling the economy, but again, not relieving inflation. Surging prices still reflect the extraordinary Money Supply stimulus following the Pandemic-driven collapse.

According to Shadow Stats’ alternative inflation calculator, based on the inflation method used in the 1980s, the current inflation rate is 14%.

Unemployment

Official US BLS reports on unemployment are not true. According to Shadow Stats alternative unemployment calculation: Unemployment increased to 24.6% on top of U.6 rising to 6.8% from 6.6%.

Housing Market

The housing market is in turmoil. Given the number of interests that are trying desperately to keep prices high and even rising, the market is in churn mode. But key areas show falling existing home prices, and the expectation is for that to continue indefinitely until massive inflation has been drained from the prices.

Housing Market 2023: Is a Double-Digit Drop in Prices Coming?

Manufacturing Sector

US manufacturing has been steadily falling for decades. Occasional growth spurts are hailed as more than a transient upward movement in a downward trend.

According to the World Bank (a significant component in the current financial collapse). Global growth to see a 30-year low by 2030.

Layoffs

Layoffs across the country continue unabated. The covid-19 plandemic damaged the US economy mortally and I expect the fallout to continue until the US loses world reserve currency status and manufacturing must rebuild in order to service demand for products that will no longer be made in China and elsewhere.

Since January 1st, 2023, 1055+ companies have announced layoffs. [ Last update: March 29,2023].

136,000 Laid Off In Major U.S. Job Cuts This Quarter—More Than Prior Two Quarters Combined

QE Again

Bank bailouts continue – the new quantitative easing that is pumping hundreds of billions of inflation-causing dollars into the market.

The Federal Reserve balance sheet has gone up $400 Billion over the past week and a half – signaling the Trillions they plan to inject into the financial banking system has gotten off to a good start. Of course, these injections are massively inflationary, further exacerbating the dollar’s declining purchasing power.

Silver and gold are still on sale now: What Are You Waiting For -take advantage of this sale.

A Commodity SUPER-SPIKE Is Coming. Are You Ready for It?

Bankers preparing for the demise of the dollar: Central Banks Are Buying Gold At The Fastest Pace In 55 Years

Today commodities, in general, are in massive INVERSE bubbles; therefore, when risk-on eventually becomes risk-off, and it will, the price of commodities will SUPER-SPIKE.

Silver demand reached an all-time high in 2022, according to the Silver Institute.

Demand for silver was expected to have reached a new high of 1.21 billion ounces in 2022, up 16 percent from the year before, driven by increases in industrial use, jewelry and silverware offtake, and physical investment.

Mining stocks are beginning to come alive, and giant companies like BHP are reporting record-high earnings and stock prices. Junior mining stocks are at the launch pad and judiciously choosing the right company might be your key to banker independence over the next few years.

Demand for Silver will continue to increase this year.

Silver Spot Price: $24.25 | 1 oz. Silver Eagle Price $40.13 | Premium 65.48% ↑

Gold Spot Price: $1977.75 | 1 oz. Gold Eagle Price $2,170.70 | 9.75% ↓

* $50 face value junk silver $1,202.50 | 47.45% over spot price for 71.5% silver quarters ↑

* Sold out and unavailable at time of writing.

10 Yield: 3.51% [UNSTABLE! And Hard To Manage Now]↑

Bitcoin $28,419.59 ↑

Crude Oil Price: $75.14 ↑

* note arrows show price increase or decrease over the last article.

Final Thoughts:

What are you waiting for?

If you are not making plans now to get out of dollar based financial markets and converting your dollars into purchasing power preserving or productive assets you are going to face one of the worst financial calamities in history.

The American middle class is targeted for destruction and only those that can see what is coming will survive. Lets be honest, this collapse will cost millions of lives over the next four to five years.

If you have dollars in banks, especially local and regional banks, you might be wiped out. It is likely our FDIC insurance will eventually reimburse you up to to $250k but that can take time, especially in the middle of a financial system in full free-fall. And while you wait, those dollars will continue to devalue.

It is always a good idea to keep money in several banks, then if one of them falls, you have cash and more time to act because of bank diversity.

The final plan should be to move out of banks and store your wealth in purchasing power preserving metals and commodities.

Legendary investor Jim Rogers on Wednesday told financial advisors their most important challenge is to learn about commodities because real assets will be the best place to invest the next 10 years. source

Here are a few things of immediate importance.

Move out of cities.

Convert dollars that will be held hostage in the banking system to silver (and gold).

Keep Enough cash on hand for a month of typical requirements.

Keep stocking up on food.

Purchase and stockpile items for barter in times when money is not accepted.

Purchase productive assets (farms, farmland, tractors, specialized machinery).

Make preparations for gasoline and diesel fuel shortages coming this winter.

Obtain necessary components of cooking – cooking oils, flour, sugar, seasonings, etc.

Learn new skills. Fishing, hunting, food storage, gardening.

Purchase a water purification system.

Home cooking supplies including fuel for stoves.

Medical supplies for humans and animals.

Invest in solar equipment for power generation.

Consider communications a priority and invest in radio equipment (shortwave receivers, shortwave radios (get your license), GMRS radios.

Jack Mullen, MBA

* Note I am not giving advice, only my opinion, I am not a financial advisor. This article represents my thoughts about the economy only.