Our current marketplace is characterized by deep-rooted manipulation, where factors such as the ten-year bond yield, currently sitting at 4.448%, epitomize the distortions rampant within our financial architecture. This yield, while reflective of investor sentiment and economic forecasts, is also a byproduct of the Federal Reserve’s heavy hand in the markets – a hand that is seemingly tightening its grip as the velocity of the money ratio continues its rise, indicating a quickening with regards to the circulation of money within the economy. For More Click The Button Below.

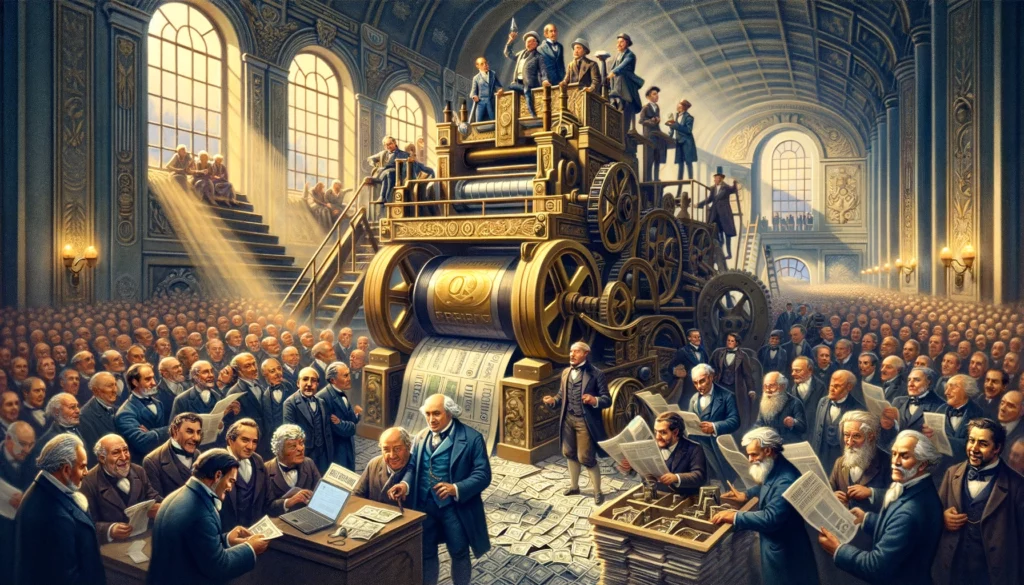

Recent political trends, under the guise of emergency stimulus and ad hoc economic salvos, have further decoupled our economic outcomes from reality. Real economic value is created by production and innovation, not minting currency. And yet, we’ve witnessed the latter in spades. For More Information Click The Button Below.

Remember, when the sirens of the debt-laden monetary system sing their final, resounding note, it will be those who hold tangible assets who will weather the storm.

In these troubled waters, gold and silver stand as lighthouses guiding the wayward ships home. The premium prices for physical metals reveal an unwavering demand and an innate wisdom that transcends market turbulence. Pre-1964 coins, often called ‘junk coins,’ are anything but rubbish; they represent a vestige of value, a currency whose worth is inscribed in its substance, not just belief. Click The Button Below For More

- 1

- 2