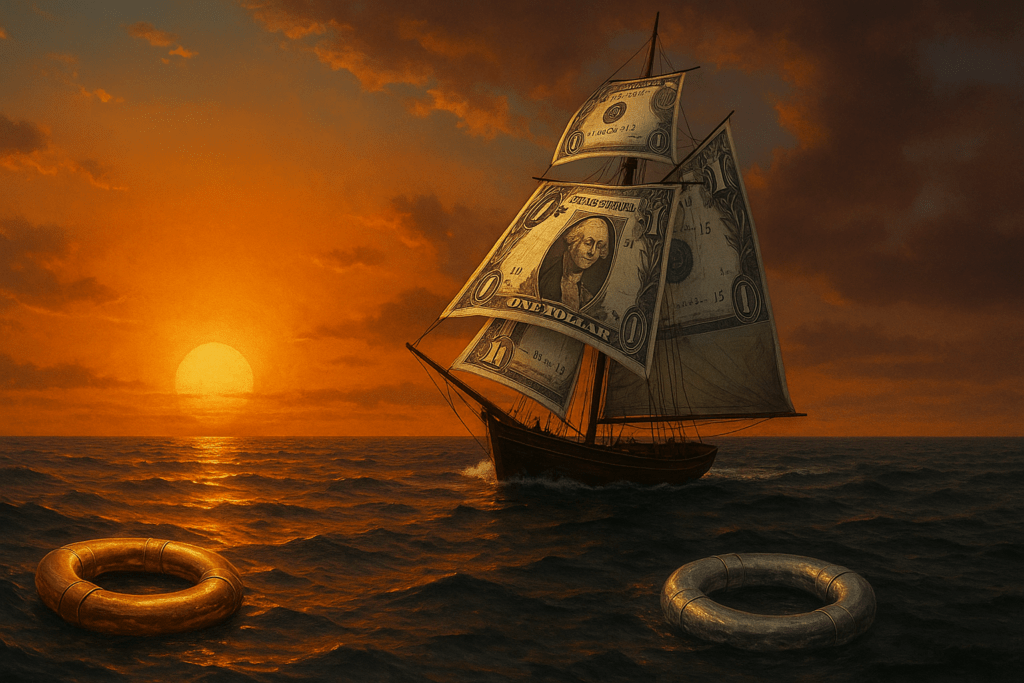

In recent developments, Moody’s has downgraded US debt to an “Aa1” rating, citing a rising debt load and interest rates that significantly surpass those of similarly rated sovereigns. This downgrade signals waning global confidence in the US financial landscape. Additionally, nations worldwide have become net sellers of US debt, indicating a strategic divestment from what was once seen as a safe bet. The downgrade, avoidable had the agenda been to salvage and repair the US Dollar by employing monetary measures of interest rate hikes and measures to cap and reduce spending, comes as no surprise.

What happens, however, if people expect that, in the future, the money-supply growth rate will increase to ever-higher rates? In this case, the demand for money would, sooner or later, collapse. Such an expectation would lead (relatively quickly) to a point at which no one would be willing to hold any money — as people would expect money to lose its purchasing power altogether. People would start fleeing out of money entirely. This is what Mises termed a crack-up boom. For More Click The Button Below.