In recent developments, Moody’s has downgraded US debt to an “Aa1” rating, citing a rising debt load and interest rates that significantly surpass those of similarly rated sovereigns. This downgrade signals waning global confidence in the US financial landscape. Additionally, nations worldwide have become net sellers of US debt, indicating a strategic divestment from what was once seen as a safe bet. The downgrade, avoidable had the agenda been to salvage and repair the US Dollar by employing monetary measures of interest rate hikes and measures to cap and reduce spending, comes as no surprise.

The systemic manipulation witnessed within our economies—distant from free-market principles—leads to a distortion of outcomes; market inefficiencies become not just a byproduct but a defining trait. Manifested through policies distanced from economic reality, these forces occasioned an Opus of financial instability, reverberating through housing, employment, and automotive sectors. Click The Link Below For More Information.

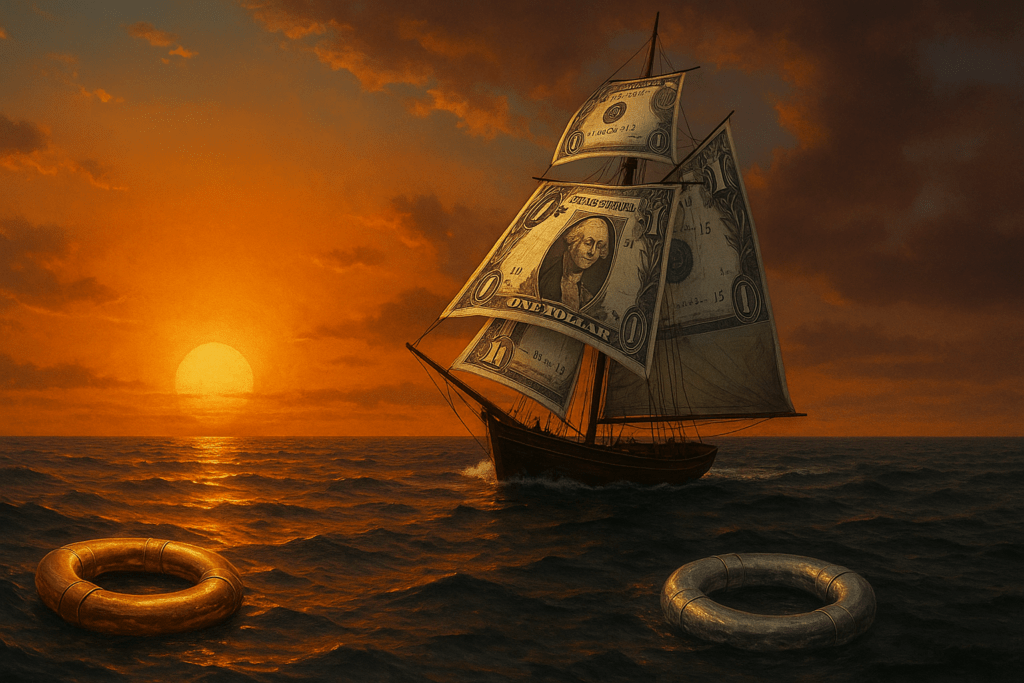

Ignoring these signs is to risk being swept away in the potential collapse that looms ominously. The wise will observe, plan, and move resolutely toward assets that have withstood the test of time, embracing the tangibility of gold and silver, forever immune to default and forever valued by those who understand the true nature of wealth. Please Click The Button Below for More Information

In these troubled waters, gold and silver stand as lighthouses guiding the wayward ships home. The premium prices for physical metals reveal an unwavering demand and an innate wisdom that transcends market turbulence. Pre-1964 coins, often called ‘junk coins,’ are anything but rubbish; they represent a vestige of value, a currency whose worth is inscribed in its substance, not just belief. Click The Button Below For More