The US Dollar’s performance continues to be a focal point for global markets, especially amid current volatility and uncertainty. While no data within the sources explicitly confirms a dramatic “collapse” of the US Dollar, there is extensive information on macroeconomic instability, investor sentiment shifts, price trends of major commodities and cryptocurrencies, and high-profile commentary from central bankers and policymakers.

Shouldn’t we expect making America Great Again to involve a return to Constitutional currency and the privacy of transactions for which it protects would be a significant part of the greatness we seek? To Read More Click The Button Below.

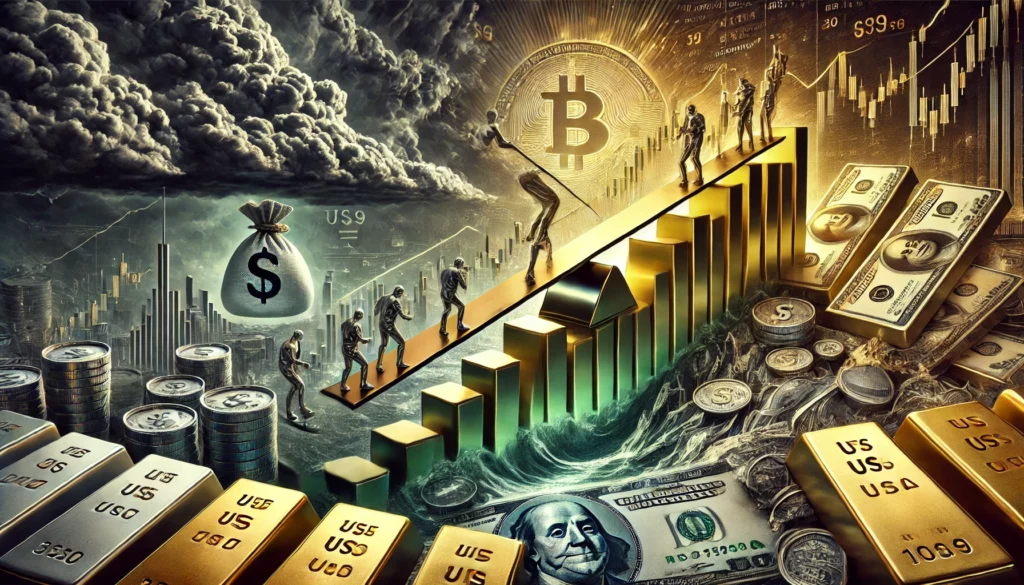

Mitigatory measures must be swift and grounded in economic reality: slash debt expansion, curtail the financialization of our economy, and promote policies conducive to sound money principles. Should we tread this path of prudence, I foresee an economy rejuvenated by the discipline that gold and other precious metals symbolize—a turn from the fragile paper edifices of today to a firmer foundation of fiscal trust and market resolve. To Read More Click The Button Below.

The persistent rise in public and private debt cannot be ignored over a more extended horizon. As inflation chips away at purchasing power and central banks toy with interest rate mechanisms in vain efforts to stave off recessions, gold will likely solidify its role as the standard-bearer of economic certainty. To Read More Click The Button Below.

The debt-laden narrative of the U.S. financial system lumbers forward unabated. Our national debt is a Jenga tower built on the quicksand foundation of fiat currency and low interest rates, and the perilous stack grows taller by the quarter. This exponential increase in debt, juxtaposed against the modest contraction in crude oil inventories, reflects an economy still reeling from the complexities of supply chain reconstruction, consumer behavior mutation, and proclivity towards demand-stimulating policies. For More Information Please Click The Button Below.

Predictions, therefore, skew towards caution in the face of escalating monetary and fiscal imprudence. As the current trends continue, we will witness a decoupling—precious metals rising as fiat currencies dilute their efficacy amidst sovereign debt crises and inflationary pressures. The equity markets, shouldered by speculators rather than investors, can expect a correction aligned with historical price-to-earnings ratios once the tide of easy money recedes. To Read More Click The Button Below.