In this turbulent environment, gold’s historical preservation of wealth is not to be underestimated. Similarly, silver’s lower price point and high industrial utility—reflected in its current market price of $30.23—make it a strong candidate for investment. Notably, pre-1965 coins seem especially relevant given their metal content and lower premiums over the spot. The to-silver ratio is staying at unnatural highs, currently 100! One hundred ounces of silver to buy a single ounce of gold. We are seeing a distortion of reality caused by financial mass manipulation, and it should cause most of you to sell your gold and buy silver! It’s a silver gift to all of us. Click The Button Below To Read Article.

This market report evaluates key economic indicators and commodities, conjecturing their potential impact on investment dynamics and the dollar’s value. Amidst the sudden heavy purchase of debt, stubborn bond yields, and rising commodity prices, our analysis focuses on providing insightful guidance for investors navigating through foggy financial terrains. Click The Button Below For More Information.

The latest moves in the debt market, with sweeping purchases of government bonds, reflect a broader search for security, prompting lower yields on the 10-year Treasury. This trend typically attracts investors toward safer assets during uncertain economic climates. However, the 10-year yield, even after temporary drops, has climbed above 4.5, a significant indicator of a debt market crisis that remains unresolved. To Read The Article Click The Button Below.

Recent market data suggest several concerning trends that could impact the dollar’s value. Investors are advised to closely monitor developments in the housing and automobile sectors, commodity prices, and precious metals markets, as well as credit and government financial metrics, to make informed decisions. The outlook for the next three months indicates heightened volatility and a possible turn towards safer investment havens. For More Information Click the Button Below.

Precious metals like gold and silver faced corrections after their recent gains, while industrially significant metals like platinum and palladium saw legal developments potentially affecting their prices. The cryptocurrency market continued to suffer outflows. Goldman Sachs reached a settlement over a metals-related lawsuit, suggesting possible impacts on the firm’s financial performances ahead. For More Information Click the Button Below.

Investors are advised to seek shelter in traditionally safer assets like gold and other precious metals amidst ongoing uncertainty. Considering diversification into commodities with growth potential such as agricultural goods and metals used in technology may be prudent. Cautious attention to the credit market is recommended, with a focus on high-quality bonds as hedging instruments. Click the Button Below To Read More.

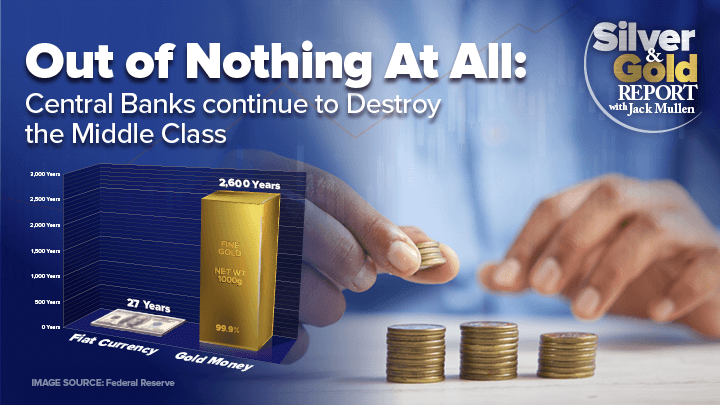

If debt is the problem, how is raising the debt ceiling the solution? -Ron Paul There are no free markets, only managed markets controlled by a collective of global entities using AI software to buy and sell assets at near light speed. Over the course of the past 40 years, the American financial system and […]