Vince Lancy’s Morning Markets and Metals report explores the exciting world of gold and silver. Experts believe these metals might soon outshine stocks. Citibank warns there might not be enough gold to meet demand. The report also suggests keeping an eye on the US dollar’s role and advises caution when trading gold. …Learn More, Click The Button Below.

China’s secret gold buying has pushed gold prices to new highs. Meanwhile, the market is shaky because AI stocks might be overpriced, and the Federal Reserve might not lower interest rates. These issues, along with worries about AI profits, have caused a market slump. Even so, gold is still a safe investment choice. …Learn More, Click The Button Below.

Vince Lancey’s platform is a go-to for financial news, especially about precious metals like gold. With over 14,000 subscribers, it explores big topics like Russia’s missing gold and China’s vaults. Meanwhile, Tether is growing in Asia, and gold prices might rise. Stay informed, but remember, this isn’t financial advice—just helpful insights! …Learn More, Click The Button Below.

Arcadia Economics talks about how China is changing how we use gold by turning it into a digital asset. This could lead to a new financial system not based on the US dollar. Meanwhile, a Chinese tech company is giving gold as bonuses, showing how much they value wealth. The market is also seeing unusual activity with gold and silver. …Learn More, Click The Button Below.

First Majestic Silver had a great third quarter! They made almost twice as much silver as last year, producing 3.9 million ounces. Their earnings jumped to $285.1 million, thanks to selling more silver and higher prices. They also made over 35,000 ounces of gold. Their operating earnings reached an impressive $99.1 million. …Learn More, Click The Button Below.

Vince Lancey shares exciting news about gold prices going up and how AI data centers might be risky. He explains how gold and silver are moving more to China and warns that AI could be a bubble, like past ones with trains and the internet. Stay informed and understand these changes in our world! …Learn More, Click The Button Below.

Gold prices might reach $4,200 by year’s end, thanks to a weaker dollar and strong demand. They could even hit $4,700! The World Gold Council’s report helps us understand these trends, showing how central banks’ actions, like selling gold, impact prices. Meanwhile, silver remains strong despite its ups and downs. …Learn More, Click The Button Below.

The Arcadia Economics channel talks about the fascinating history of gold and silver! For centuries, the gold to silver ratio was 12:1 until big changes in 1873. Learn why understanding this history helps us today. Plus, check out our website updates and the new documentary, *Silver Sunrise*. Stay informed to make smart choices in our changing world! …Learn More, Click The Button Below.

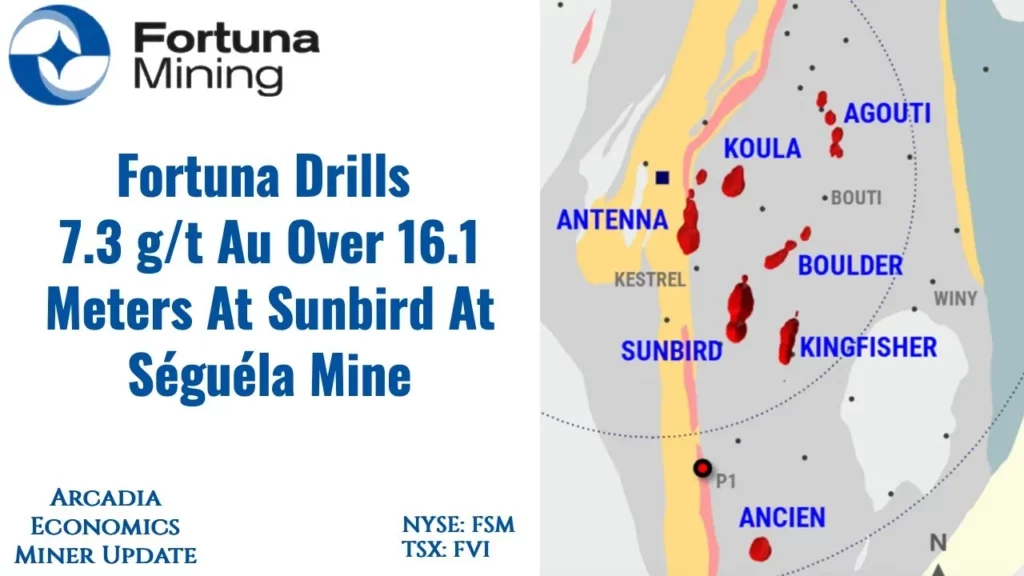

Fortuna Mining has exciting news from their Sunbird site in Cote d’Ivoire! They’ve found lots of gold and even discovered a second underground area rich in gold. With five drilling machines working hard, they’re exploring deeper and finding more gold. They’re also starting a study to learn more about the underground treasures. …Learn More, Click The Button Below.

Arcadia Economics talks about how india is planning to bring back a lot of gold to keep its money safe. This is because other countries have had their reserves taken away. Gold is becoming more important worldwide. Recently, gold prices went up, but then dropped after the Federal Reserve changed interest rates. It’s a good time to buy gold now. …Learn More, Click The Button Below.