As we examine the current doldrums of the US and Western financial systems, the consequences of fiscal imprudence are becoming increasingly impossible to ignore.

Continual engagement in fiscally reckless policies and an enduring reliance on debt-fueled growth models have placed our economic vessel in dangerous, uncharted waters. With a student’s respect for Austrian Economics, I can’t help but discern the approaching maelstrom provoked by the profligate monetary policies of central banks, which stand in striking contrast to the sagacity of Ayn Rand, Ludwig von Mises, and other legendary advocates of market freedom.

Reviewing my previous warnings about the rising tide of debt and misallocated resources, let us chart the latest developments. The cessation of the petrodollar system heralds a shift in global monetary dynamics, with potential repercussions for the US dollar’s role as the world’s reserve currency.

Consequently, the fiscal stability of the US, heavily propped by the dollar’s exorbitant privilege, is under threat. As nations potentially move away from dollar-denominated trade, the demand for the currency may wane, amplifying domestic inflationary pressures.

Author’s Note: Please consider the enormity of the central banks’ plan to force all of us into their central bank digital currencies (CBDCs). Our financial controllers will attempt to impose CBDCs on humanity – forcibly and with the violence that accompanies such significant change. Those unprepared will not have options to resist what will be shown to be the most devious and terminal system of slavery ever created.

Moreover, the volatility of gold prices poses a conundrum for investors seeking refuge from currency debasement. While gold and Bitcoin are frequently touted as hedges against inflation, their effectiveness could be more representative in our current environment. Amidst these uncertainties, the stock market exhibits signs of exuberance detached from the underlying economic metrics—a classic symptom of monetary inflation and artificially low interest rates, as highlighted by the alarming Price-to-Earnings (P/E) ratios.

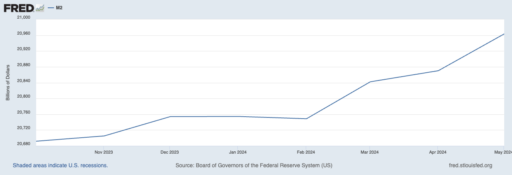

Money creation by the Central Banks has continued relentlessly upward since October of 2023 (chart below.)

Over the same period, the S&P 500 rose proportionally, with the index 34% higher (see below.) The stock market is a derivative of the debt market, and as currency is spoken into existence to service ever-increasing debt, the stock market is the bellwether of this newly created inflation.

In the commodities sector, the narrative is not one of scarcity but of valuation distortion. Silver, for instance, is anticipated to surge. Yet, this projection does not spring entirely from increased industrial demand or intrinsic value but from the years of price suppression and scarcity caused by unnatural and politically motivated price fixing.

Looking forward, my short-term outlook envisages increasing market volatility with an eye on the tension between inflationary pressures and Federal Reserve policies.

We may witness erratic oscillations in commodity and asset prices as investors navigate the ambiguous signals from policymakers. If Jerome Powell and the Federal Reserve persist in their pacific stance towards interest rates, they may feed the inflationary fires they seek to douse, further undermining the dollar. But my friends, we know this outcome has already been decided, and rather than hope for policy changes, we must plan as if no changes will be forthcoming.

Long-term, if the current trajectory of debt accumulation and central bank intrusiveness continues, the forecast is dire. Authorities might unintentionally steer the economy towards stagflation—where stagnating growth and high inflation corrode the general prosperity. Such a scenario would only reaffirm my conviction that adherence to free-market principles is paramount.

The call to action remains consistent with my preceding appraisals: the de-leveraging of bloated government balance sheets, curtailment of reckless spending, and an overhaul of the remit of central banking. The goal should be a return to sound money principles involving competitive currencies free from state monopoly control. This course would inoculate economies against the contagion of unchecked monetary expansion and reduce susceptibility to the whims of central planners.

To mitigate the impending crisis, I urge policy shifters to adopt a prudent approach: curtail credit expansion, normalize interest rates, and diminish state influence on markets. It is imperative we recalibrate our compass to navigate out of the current financial upheaval. Failure to right the ship will likely lead us to the inevitable encounter with the cruel rocks of economic reality.

Only through discipline, foresight, and an unwavering commitment to market values can we hope to reach the safe harbor of economic stability and prosperity.

Be not deceived – be prepared ~ Silver Savior

WhySilverNOW.com (why is silver the most undervalued financial asset in the world)

Get Your Free Gold Wealth Kit Here

- Note: We are not giving advice; we only give our opinion; we are not financial advisors. This article only represents our thoughts about the economy.