Arcadia Economics talks about how when the dollar isn’t as strong, things like stocks, bonds, gold, and silver can become more valuable. This is because they do well when the dollar is weak. So, if you hear the dollar is getting weaker, keep an eye on these items. Their value might go up!” …Learn More, Click The Button Below.

Arcadia Economics talks about how silver and gold markets are steady, good for silver makers. Rate cuts by the Federal Reserve might not improve jobs or wages. Canada’s plan to control housing prices isn’t working well. In Mexico, changes might affect mining. The mining sector is hopeful and focused on minerals like lithium for electric cars.” …Learn More, Click The Button Below.

Vince Lanci on Arcadia Economics talks about the current state of markets like silver, gold, and the dollar. He hints at a possible stock market drop and gold prices rising above $2400. The report also discusses world events and their effect on the market. It also mentions a special offer on silver Britannias coins from Arcadia. …Learn More, Click The Button Below.

This blog post talks about the gold and silver market today, comparing it to past trends. It suggests that gold and silver prices might go up soon. It also talks about a company called Fortuna Silver Mines, which is doing well. Lastly, it discusses how rumors of war might affect the market. …Learn More, Click The Button Below.

Arcadia Economics talks about mbridge, a new trading platform made by four Asian banks, is now open to the public. It uses gold and other things instead of dollars for trading. The Bank of International Settlements is helping to run it. Europe might lower its rates to help its economy and hopes the U.S. will do the same. Nvidia is now the world’s second biggest company.” …Learn More, Click The Button Below.

Arcadia Economics talks about how Fortuna Silver is selling special ‘notes’ worth $150 million. They’re also giving an option to buy more within 15 days. This money will help pay off bank loans and support the company’s work. It will make the company stronger and give them more freedom with their money. Lots of people want these notes, so they’ll likely sell fast.” …Learn More, Click The Button Below.

Arcadia Economics in this blog post explores the rising value of silver and gold. It discusses global tensions, the U.S.’s controversial decisions, and how these could affect trust in the U.S. It also talks about countries favoring precious metals over U.S. bonds, indicating a shift towards tangible assets. The post ends by recommending investment in silver due to its current low prices. …Learn More, Click The Button Below.

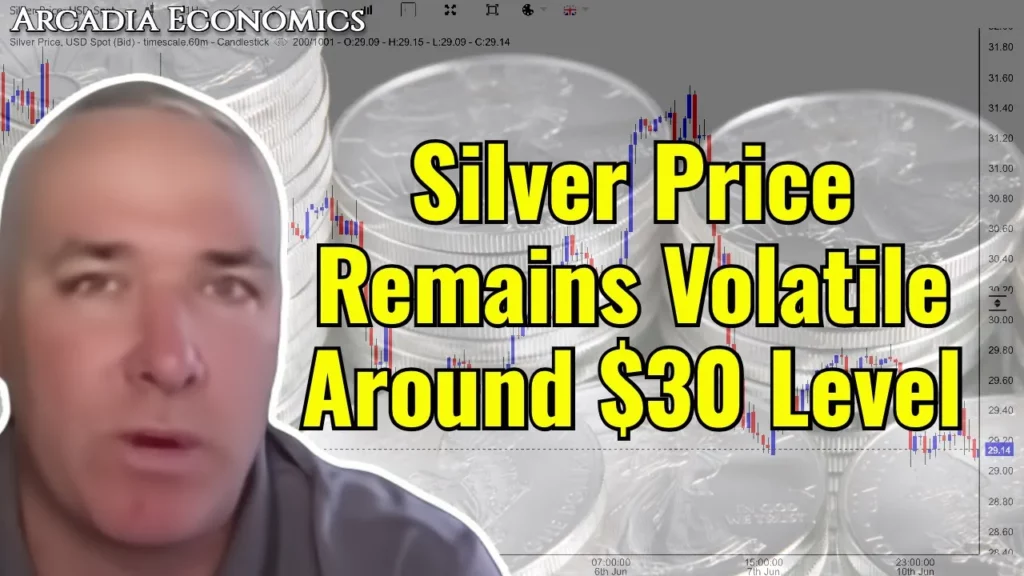

Vince Lancy’s report discusses the recent shift from gold to silver investments, causing market changes. He talks about various market indicators and potential recession risks. The report also covers inflation waves, the US manufacturing sector, and the stock market. It highlights gold and silver’s performance and upcoming economic data. Always consult a financial advisor before making decisions. …Learn More, Click The Button Below.

Arcadia Economics talks about how India’s Reserve Bank bought more gold in early 2024 than all of 2023! This info comes from a report by Vince Lancey. He also talked about a big meeting about metals like gold and copper. Despite a possible slowdown, people in India still want gold. Also, there’s news about a possible peace deal in Gaza and upcoming job data. …Learn More, Click The Button Below.

This week’s Silver Report talks about changes needed in gold trading reports due to too many short sales. It also notes less interest in China’s silver contracts since 2021, but prices are going up as real products replace derivatives. The report mentions busy bank-to-bank lending markets and rising gold and silver values. Lastly, it shows the profitable Boratuna Silver Mine’s …Learn More, Click The Button Below.