Friends, the US financial system is wholly unstable. Troubling Trump tariffs have yet to complete the job intended—not rebuilding the current US economic system but destroying it. For those still clinging to Trump’s plan (trusting, of course), there may well be another day of financial/economic growth in the US future, but unfortunately, there may be far fewer people to witness its return. To Read More Click The Button Below.

Silver News Daily talks about how silver is becoming more valuable because it’s used in many important technologies like solar panels and electric cars. As these industries grow, they need more silver, but there’s not enough to go around. This makes silver harder to find and more expensive. Experts think its price will keep rising, so it’s a good idea to pay attention! …Learn More, Click The Button Below.

Trump Euphoria, Financial Markets, Economic Instability, Precious Metal Prices, Gold Prices, Silver Prices, Debt Crisis, Austrian Economics, Safe Haven Assets, China Gold Reserves, Global Monetary Stability, Central Bank Monetary Policy, Low Interest Rates, Quantitative Easing, Fed Monetary Policy, Inflationary Pressures, Political Uncertainty, Investor Sentiment, Capital Flows, Click The Button Below For More Information.

Learn how to navigate the tricky economy with tips from trading expert, Troy Noonan. He teaches how to make day trading a sustainable way to handle economic instability. Trading is like a business deal – sometimes you win, sometimes you lose. But with Troy’s guidance, you can learn to make smart choices and profit from changes in the economy.” …Learn More, Click The Button Below.

Dr. Steve Turley talks about politics in America, including challenges in Biden’s campaign. It emphasizes the value of faith, family, and freedom. It also introduces Jordan Bush, a Bitcoin supporter, who explains why understanding money matters. The post also mentions a Bitcoin conference in Nashville. It explores how Bitcoin could help when regular money systems fail. …Learn More, Click The Button Below.

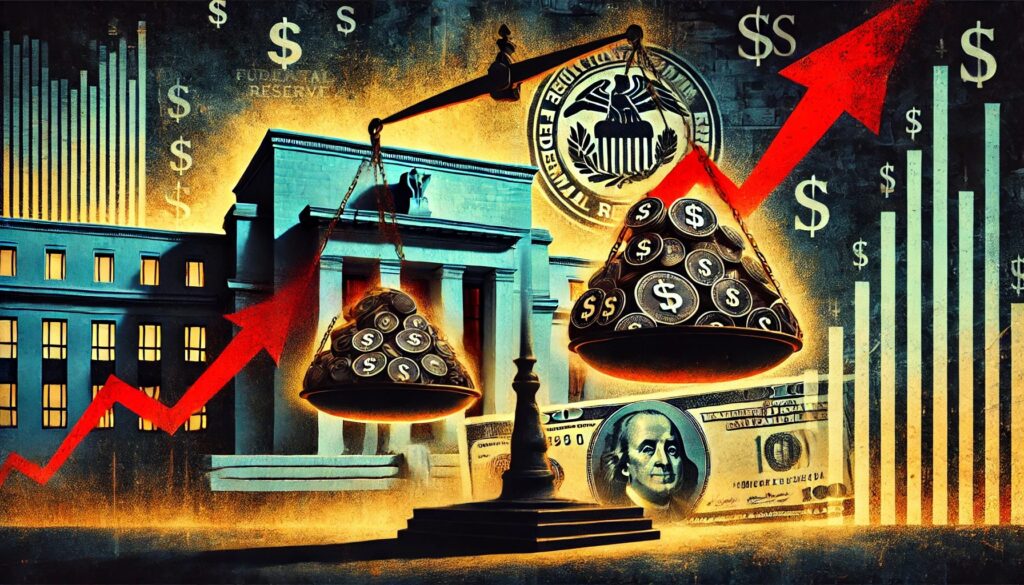

Arcadia Economics talks about how despite less money in circulation, the stock market keeps breaking records. This is because it’s not just tied to the amount of money around. The Federal Reserve helps by providing funds to banks. But, there could be risks. Also, rising house and stock prices are causing inflation. Lastly, the article talks about the overpriced housing market.” …Learn More, Click The Button Below.

In his pre-market report, Gregory Manorino highlights the Federal Reserve’s intervention, which has resulted in an artificially suppressed debt market. This has led to a decrease in the ten-year yield and dollar strength, while the MMRI falls below 300. Although stock futures and commodities like gold, silver, and crude oil show upward trends, the forecast for the future remains challenging due …Learn More, Click The Button Below.

In Gregory Manorino’s market analysis for September 20, 2023, he predicts a 25 basis point hike in the federal funds rate. He highlights the alarming global debt of $307 trillion and warns of a possible debt market meltdown. Manorino criticizes political leaders for their lack of representation and reluctance to challenge central banks. He also speculates on a potential pull Learn More, Click The Button Below

In his market report, Gregory Menorino warns of economic instability as US commercial banks seek financial assistance from the Federal Reserve. He predicts an imminent systemic crash and advises reducing reliance on banks, suggesting investments in commodities and precious metals. With increased debts and inflation on the horizon, it’s time to consider alternatives. Learn More – click the link below.

In his thought-provoking analysis, Dr. Kirk Elliott challenges the reliability of official economic figures and questions the sustainability of debt-driven growth. He highlights the alarming job cuts in the tech industry, raising concerns about the future of human employment. Dr. Elliott advocates for a shift towards real growth driven by actual spending on tangible goods. Read more to gain valuable insights into the true