Guns & Gadgets 2nd Amendment News talks about how Gun Owners of America is suing New Jersey. They say it’s too hard to get a gun permit there. They believe this goes against our right to own guns. Getting a permit in New Jersey takes a long time and costs a lot. The group also doesn’t like the rule of buying only one gun a month.” …Learn More, Click The Button Below.

This blog post explores a podcast discussing Armora Colostrum, a health product, before delving into political issues. It questions Biden’s health, Trump’s peace efforts, and corruption in politics. It criticizes immigration policies and censorship, while highlighting concerns about America’s health and the importance of church-state separation. It also speculates on potential changes in Democratic candidates and the …Learn More, Click The Button Below.

Judge Napolitano – Judging Freedom talks about how President Putin’s trip to North Korea is a big deal. Why? Because it has made Russia and North Korea military buddies, even if some news says different. This could really shake things up around the world, even if it’s not on the news a lot.” …Learn More, Click The Button Below.

On June 20, 2024, Gerald Celente and Judge Andrew Napolitano talked on Trends Journal. He spoke about the growth of DAO, gold, and digital money. He also mentioned Nvidia, now the top company in the world. But, he warned us about too much hype around AI. He’s also worried about the world’s debt problem. He wants more people to read Trends …Learn More, Click The Button Below.

The Healthy American Peggy Hall discusses individual health versus public health, questioning if one person’s health can impact another’s. She criticizes fear around disease spread and supports public sanitation. She shares a supporter’s fight against health restrictions and emphasizes health freedom. She advises on handling medical discrimination and encourages standing up for rights. Lastly, she shares a story of resilience after job loss due to personal …Learn More, Click The Button Below.

Israel might invade Lebanon, causing global money issues due to rising oil prices. This could lead to a big war, involving many countries. It could even cause a nuclear conflict. This situation is causing problems in Israel and worldwide. The article also talks about Russia’s nuclear plans, potential space wars, and economic problems. It advises readers to prepare for these changes. …Learn More, Click The Button Below.

I Allegedly talks about how major car dealerships can’t sell cars due to a cyber attack on CDK, an auto insurance software company. Occidental Casualty has stopped writing insurance in California. It’s important to use a VPN for protection against cyber attacks. Real estate listings are going stale, and ‘zombie mortgages’ are on the rise. Remember, always stay safe online!” …Learn More, Click The Button Below.

Rafi Farber talks about a big bank in Japan that is selling lots of bonds because they’re not making enough money. They hope to use that money in better ways. But, this is making people worry about the bank’s health and how it will affect Japan’s money, the yen. Some think this might make the U.S. lower their interest rates, which could help the yen. …Learn More, Click The Button Below.

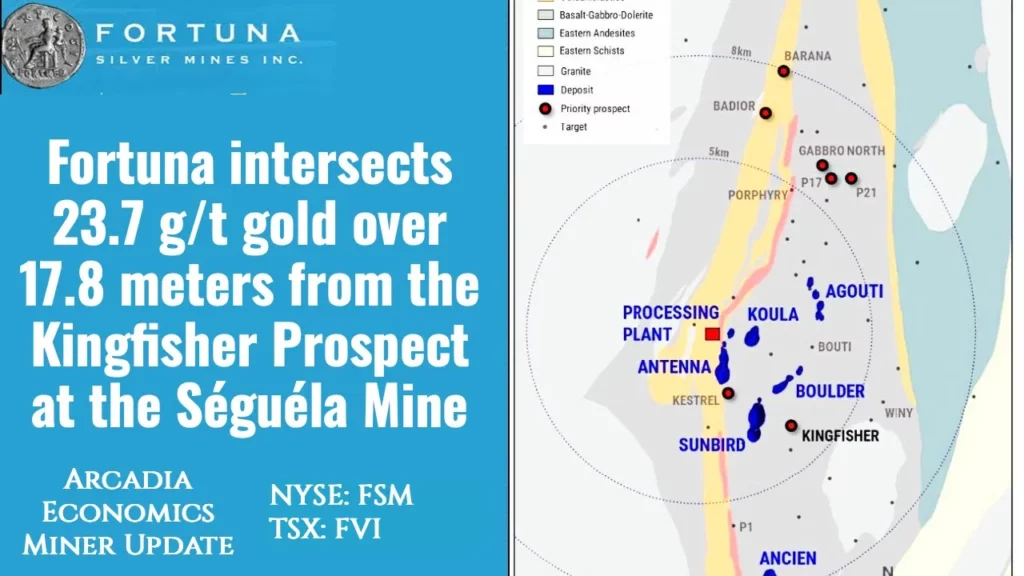

Arcadia Economics talks about how Fortuna Silver, a mining company, found lots of minerals at the Sequedal Mine in Cote d’Ivoire. The Kingfisher Prospect area has lots of growth. They also found good stuff at Batiore and Ancien. They plan to keep drilling in 2024 to find more minerals and hope to start making things by 2025. …Learn More, Click The Button Below.

In this blog post, Dan Bongino shares his strong views on Bill O’Reilly, Democrats, and voter fraud. He also talks about his partnerships and commitment to conservative causes. Bongino challenges O’Reilly to confront him directly. He criticizes liberals, government initiatives, and discusses the importance of good sleep. The post also touches on Homeland Security issues and gender …Learn More, Click The Button Below.