The blog post explores how new tariffs might change global trade and affect precious metals like gold and silver. While some experts think these tariffs will be short-lived, others warn they could cause big problems for the economy. With rising gold and oil prices, investing in precious metals might be a safer choice than stocks. …Learn More, Click The Button Below.

Gold and silver are being moved from London to New York and China, a process called repatriation. This isn’t just because of tariffs; there are other hidden reasons. London might not be the main storage place for these metals anymore. People are losing trust in the old system, causing more gold to leave London. …Learn More, Click The Button Below.

Arcadia Economics talks about how London’s gold market is in trouble because there’s not enough gold and silver. This shortage is making banks borrow gold from central banks. Even big banks like BNP are buying gold for themselves. Countries like China and the US are buying lots of gold, causing more problems. Experts think gold prices might go up soon. …Learn More, Click The Button Below.

Arcadia Economics talks about how traders in New York are collecting $82 billion in stocks because they’re worried about new tariffs. This has slowed down the process of taking gold from the Bank of England, making it take weeks instead of days. There’s now less gold in London and more in New York, causing market stress but not affecting silver prices. …Learn More, Click The Button Below.

Richie from Boston shares his worries about AI, claiming it can see things even when cameras are off. He thinks AI might be connected to otherworldly beings. Richie also warns that AI can use Wi-Fi to track people and believes it’s dangerous. He urges caution, fearing AI’s rapid growth and mysterious powers. …Learn More, Click The Button Below.

Arcadia Economics talks about how gold prices have dropped recently due to several factors, including Nvidia’s crash and tariff threats from Donald Trump. Vince Lancy explains how these events, along with the approval of a new Treasury Secretary, are affecting the market. Despite the challenges, UBS predicts a positive future for gold. Meanwhile, tariffs are impacting industries like steel, aluminum, and computer chips. …Learn More, Click The Button Below.

Vince Lanci Morning Markets and Metals report explores how silver is acting differently from the stock market, hinting at a possible rise if gold prices go up. It also raises questions about MicroStrategy’s Bitcoin buying strategy, which some think resembles a Ponzi scheme. The report touches on how Trump’s policies might weaken the dollar, boosting gold. …Learn More, Click The Button Below.

Gold and silver might become harder to find because of money problems and worries about taxes. Platinum, which is even rarer than gold, could be a smart investment. By 2025, mining might get better, making precious metals a good choice. Learn more about this exciting market and why the future looks bright for investors! …Learn More, Click The Button Below.

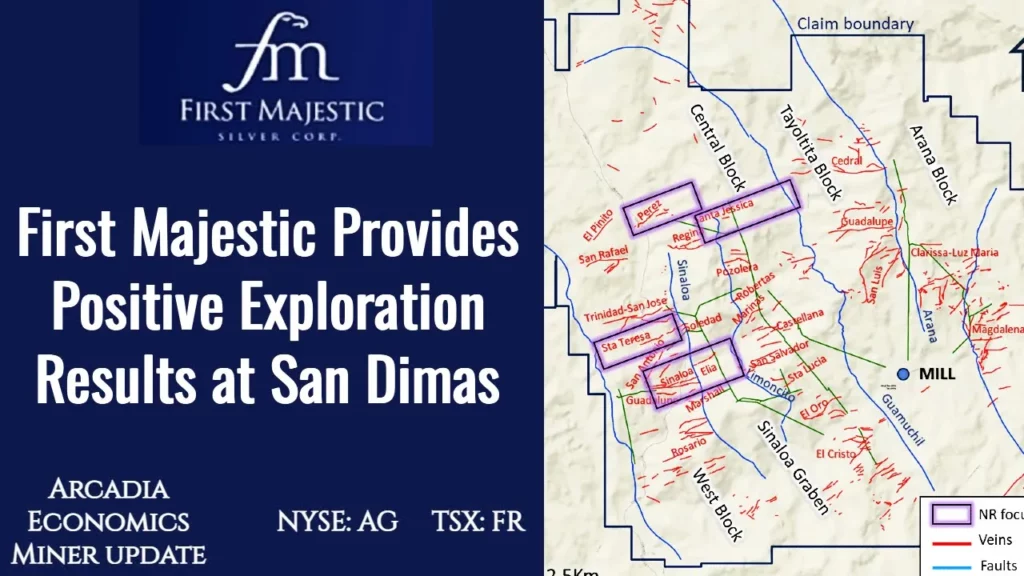

First Majestic’s drilling at San Dimas found lots of silver and gold! This means they can soon start mining these treasures. The drilling also hints there might be even more hidden resources nearby. It’s an exciting time for the team as they confirm these findings. Want to learn more? Click the link in the description! …Learn More, Click The Button Below.

Arcadia Economics talks about how china’s government now lets people buy and own real gold! This big change started in 2023 and helps everyone learn about gold trading. Citizens can open accounts at the Shanghai Gold Exchange. This move might change things worldwide, as China aims to protect its economy and prepare for future global trade shifts. …Learn More, Click The Button Below.