In recent developments, Moody’s has downgraded US debt to an “Aa1” rating, citing a rising debt load and interest rates that significantly surpass those of similarly rated sovereigns. This downgrade signals waning global confidence in the US financial landscape. Additionally, nations worldwide have become net sellers of US debt, indicating a strategic divestment from what was once seen as a safe bet. The downgrade, avoidable had the agenda been to salvage and repair the US Dollar by employing monetary measures of interest rate hikes and measures to cap and reduce spending, comes as no surprise.

The signals are becoming more intense to those discerning readers: the Federal Reserve’s latest bid to resuscitate the ailing economy through asset purchases has done little more than apply a temporary bandage. Rates are creeping up once more, with the U.S. 10-year Bond Yield now steadfastly refusing to stay down after a few days of Fed money printing remains starkly elevated at 4.27%. It is as if we are counting down the final ticks of the clock for a dollar-based debt currency life cycle. Click The Button Below For More Information.

Regardless of Trump and Elon’s promises to keep the BRICS nations from destroying the dollar – it is clear the Federal Reserve is actively destroying the currency now. Lowering interest rates into rising inflation while the debt market continues to implode is an Econ 101 lesson on what not to do to preserve the purchasing power of a debt-base-theft-currency. To Read More Click the Button Below.

Significant government debt purchases impact bond yields and signal potential shifts across multiple sectors, including housing, commodities, precious metals, and cryptocurrencies. A host of key market indicators and macroeconomic policies are poised to influence the dollar’s valuation. We guide investors to navigate the current landscape, emphasizing prudent investment strategies. Click The Button Below To Read More.

Looking beyond investment, a liquidity crisis necessitates comprehensive preparedness. It means cultivating self-sufficiency, learning survivalist tactics, and looking after the well-being of our communities. As the prospect of a debt market collapse looms, having a cache of essential goods could be the line between hardship and security. Prepare each day for a day that will come — for the powers that be have targeted the US dollar for destruction. Click The Button Below To Read More.

The financial milieu prescribes a cautious yet deliberate approach, favoring precious metals, especially silver, for its significant upside potential. The influence of government intervention in bond markets signals an emerging preference towards commodities and possibly digital currencies over traditional fixed incomes for the immediate future. Click Button Below To Read More

The current financial landscape demands vigilance, with investors advised to hedge their portfolios effectively. Increasing allocations in silver could provide a lucrative offset owing to its depressed valuation relative to gold. The government’s influence in debt markets calls for a continuous assessment of yields when considering fixed-income investments. As we move towards year-end amidst political events and data-driven policy decisions, diversification across asset classes—including precious metals, selective commodities, and equities—remains prudent. Crypto markets will continue to benefit from the Trump Bump and we are currently very bullish the crypto space assets. Click the button below to read more.

The financial milieu prescribes a cautious yet deliberate approach, favoring precious metals, especially silver, for its significant upside potential. The influence of government intervention in bond markets signals an emerging preference towards commodities and possibly digital currencies over traditional fixed incomes for the immediate future. To Read More, Click The Button Below.

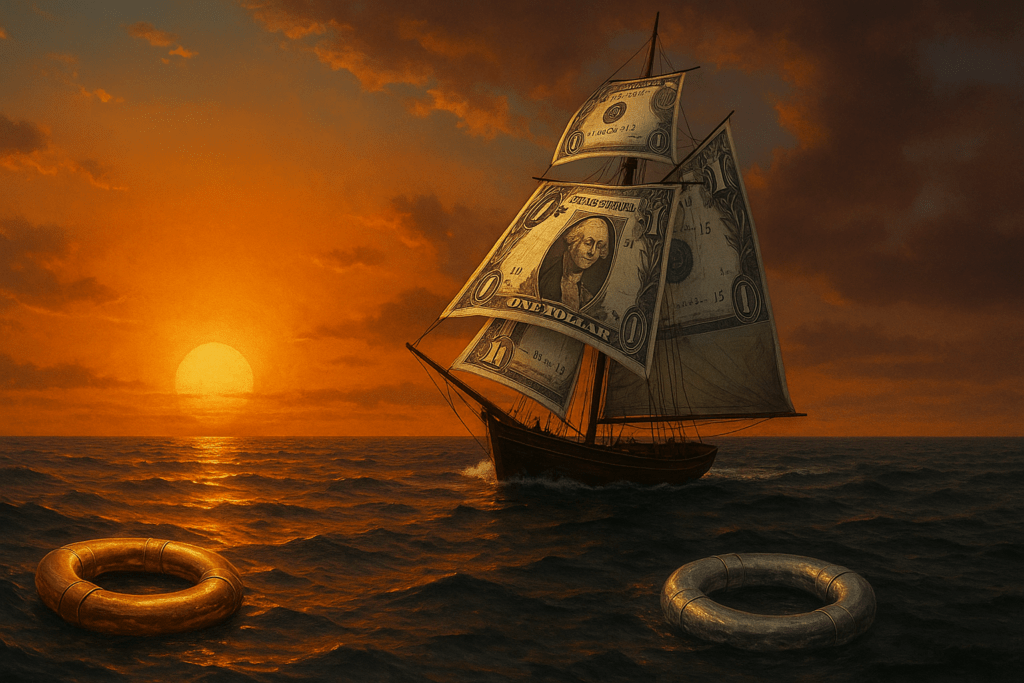

Our financial fabric unravels daily. The U.S. Debt markets stand on the brink, threatening to cast us into a liquidity abyss from which recovery could be generational. In this crucible, gold and silver represent more than mere assets; they are lifelines ensuring that your wealth and well-being outlast the dollar’s demise. To Read More Silver Savior Click The Button Below.