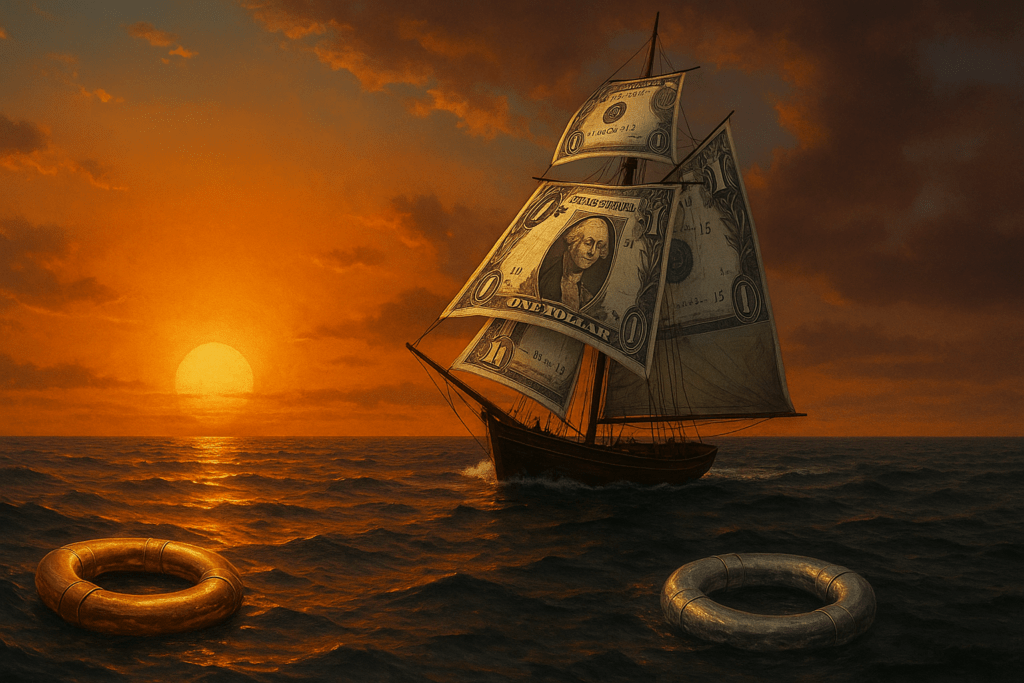

In recent developments, Moody’s has downgraded US debt to an “Aa1” rating, citing a rising debt load and interest rates that significantly surpass those of similarly rated sovereigns. This downgrade signals waning global confidence in the US financial landscape. Additionally, nations worldwide have become net sellers of US debt, indicating a strategic divestment from what was once seen as a safe bet. The downgrade, avoidable had the agenda been to salvage and repair the US Dollar by employing monetary measures of interest rate hikes and measures to cap and reduce spending, comes as no surprise.

The present rising price point of the precious metal is not an isolated event but the culmination of economic and geopolitical anxieties. Trade tensions have chipped away at the veneer of global monetary cooperation, and challenges to the dollar’s dominance have become more vocal. Dwindling faith in the greenback paves a golden path for precious metals, with investors and states questioning the longevity of the dollar’s reign as a reserve currency. Please Click The Button Below For More Information.

The systemic manipulation witnessed within our economies—distant from free-market principles—leads to a distortion of outcomes; market inefficiencies become not just a byproduct but a defining trait. Manifested through policies distanced from economic reality, these forces occasioned an Opus of financial instability, reverberating through housing, employment, and automotive sectors. Click The Link Below For More Information.

The consumer must apply a shrewd lens to the unfolding situation in the shadow of market manipulation and a departure from free-market ideals. The dollar’s decline is not hypothetical—it is a palpable reality with profound implications. Believing in the current fiscal trajectory without considering its terminus is a fundamental misstep. Solid assets must become a pillar of any strategy aimed at surviving the possible collapse that looms on the event horizon. Click The Button Below To Read More.

Mitigatory measures must be swift and grounded in economic reality: slash debt expansion, curtail the financialization of our economy, and promote policies conducive to sound money principles. Should we tread this path of prudence, I foresee an economy rejuvenated by the discipline that gold and other precious metals symbolize—a turn from the fragile paper edifices of today to a firmer foundation of fiscal trust and market resolve. To Read More Click The Button Below.

If non-interventionist solutions are not pursued to reduce debt, curb inflation, and restore interest rate integrity, the prognosis for economic health remains grim. The ever-increasing embrace of gold and cryptocurrencies indicates an anticipated systemic evolution—where value resides in tangibility and decentralization versus the capricious whims of fiat decrees. Austrian Economics provides more than just cautionary tales; it embodies the potential for a financial renaissance rooted in discipline, autonomy, and uncompromised market liberty. The choices we make today will indelibly shape the economic realities of tomorrow. For More Information Click The Button Below.

The present report addresses significant market metrics following a week of evident shifts in the economic outlook and investment preferences. Dated constructs, such as the gold-to-silver ratio, underpin the precious metals market analysis, while comprehensive bond yield activities suggest a substantial debt acquisition. The designated purpose of this examination is to aid investors in transitioning from volatile assets to more secure alternatives amidst market fluctuations. To Learn More Click The Button Below.

The crux of the situation is whether the U.S. and like-minded Western powers will recognize the warning signs offered by these guardian assets. Will it take the precipitous fraying of the fiat currency fabric to awaken a belated drive for genuine economic reform? To Read More Click The Button Below.

As we head into the final quarter of 2024, a myriad of forces are shaping the financial markets landscape. From increased government debt purchases influencing bond yields to a volatile precious metals market, investors are navigating a complex array of signals. This report dissects recent market movements and projects a 3-month outlook across key sectors, providing a compass for those seeking to mitigate risks and capitalize on emerging opportunities. For More Information Please Click the Button Below.

The trajectory of our economic pathway isn’t immutable. We carry the choice—and, perhaps, the burden—of foresight. With increasing federal debt, a dizzying stock market, and the metals market brimming with prophetic cues, heed these considerations: secure, protect, and diversify. In uncertainty lies opportunity, and in preparedness, security. To Read More Click The Button Below.

- 1

- 2