Arcadia Economics talks about how the gold and silver prices are changing! Gold stays above $3,050, while silver is close to its 2024 high of $3,507. The Federal Reserve’s interest rate cuts and market uncertainty are affecting these prices. Short positions are rising, hinting at possible price drops. Plus, the Trump administration’s policies might weaken the dollar, impacting prices further. …Learn More, Click The Button Below.

Vince Lanci gives a morning market rundown simplifies complex financial news for everyone. It covers gold, silver, and stock performances, offering insights from Michael Oliver’s 360report. The analysis suggests buying gold and silver before April 2 and selling after. It also highlights how market trends and momentum can signal future price movements, helping you make informed decisions. …Learn More, Click The Button Below.

Gold and silver prices are soaring, with gold over $3,000 and silver above $34. But will they stay high? Oil prices are also changing, with Brent Crude at $84 and West Texas Intermediate at $80. OPEC Plus is cutting production, which might make oil prices rise. Keep an eye on these market shifts! …Learn More, Click The Button Below.

Trump’s order for mineral independence might cause a silver price jump, but most people won’t hear about it. Expert Vince Lancey says if U.S. stocks fall, it could hurt markets worldwide. He also thinks silver prices could go up because of more investments, trade rules, and supply issues. Keep an eye on silver! …Learn More, Click The Button Below.

The Arcadia Economics channel talks about how the global silver market is facing challenges because of tariffs introduced by Trump. In the UK, silver supplies are shrinking fast, and borrowing costs are rising. Some silver stocks are tied up in special products, making them hard to access. Plus, fewer people are investing in mining, adding to the problem. …Learn More, Click The Button Below.

Chris Marcus from Arcadia Economics talks about how gold and silver prices are going up. Gold is now over $3040, and silver is close to $35. He remembers when gold first hit $2000 and thinks it might soon reach $3100. But he warns that prices can drop quickly, so stay alert! …Learn More, Click The Button Below.

Arcadia Economics talks about how gold is in the spotlight as banks scramble to meet demands. Vince Lancy explains how gold is becoming scarce, with some banks possibly hiding shortages. As gold prices soar, reaching over $3,000, the market is buzzing with predictions. Stay informed with daily updates, but remember to seek advice before making financial decisions. …Learn More, Click The Button Below.

Arcadia Economics talks about how Gold prices have hit a record $3,000 per ounce, sparking interest worldwide. This surge is linked to trade tensions and central bank actions. While it’s unclear if prices will hold, gold remains a top performer this year. For easy updates on gold and silver markets, check out Arcadia Economics, but always consult a financial advisor first. …Learn More, Click The Button Below.

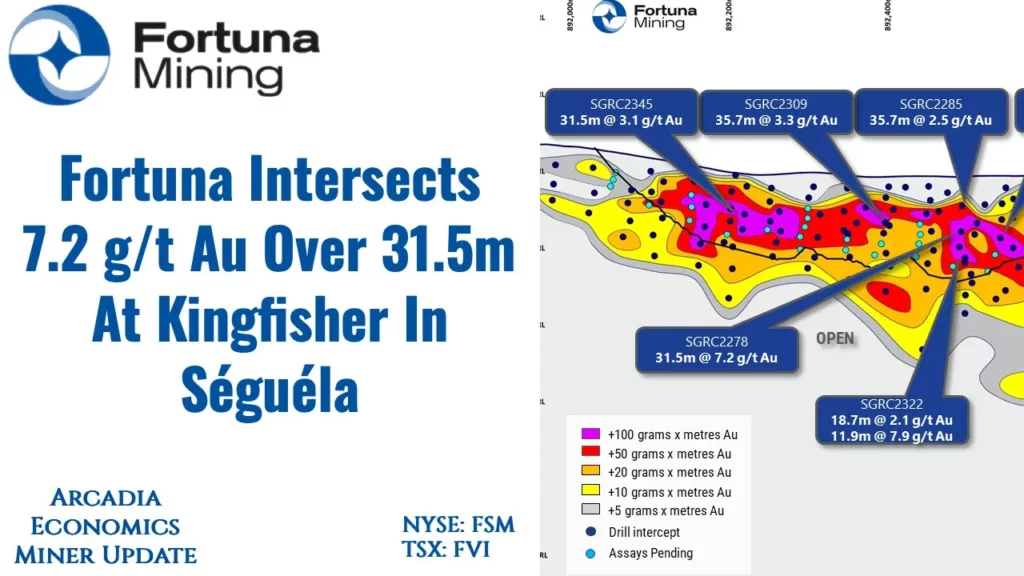

Fortuna Mining found a lot of gold at their Kingfisher site in Cote d’Ivoire, with 7.2 grams per tonne over 31.5 meters. They also discovered more gold at their Sunbird site, extending it by 700 meters. These exciting finds have boosted Fortuna’s stock, making shareholders happy. …Learn More, Click The Button Below.

Arcadia Economics talks about how Fortuna Mining found more gold than before, thanks to new drilling and discoveries. They did lose some resources because of mining, but they are working hard to find more. With a big budget for exploring, Fortuna is excited about future projects and keeping their gold reserves strong. …Learn More, Click The Button Below.