Today I found a message floating in the sea from you to me

You wrote that when you could see it

You cried with fear; the point was near

Was it you that said

How long, how long, how long to the point of no return?

How long, how long to the point of no return? No return – Kansas

The powers of financial capitalism had a far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. –Carroll Quigley

But if you want to continue to be slaves of the banks and pay the cost of your own slavery, then let bankers continue to create money and control credit. — Josiah Stamp

It would have been impossible for us to develop our plan for the world if we had been subjected to the lights of publicity during those years. But, the world is now more sophisticated and prepared to march towards a world government. The supranational sovereignty of an intellectual elite and world bankers is surely preferable to the national auto-determination practiced in past centuries. – David Rockefeller

The financial quotes above are not just interesting bits of history but rather capsulized knowledge regarding the danger of central banking. Allowing men to control the credit of a nation and, by the use of the American military, control worldwide banking and financial systems is reckless endangerment and psychologically irrational.

As history has shown, central bankers are firstly men and then criminals, represented by a large population of psychopaths pursuing humanity’s damaging agendas.

Bankers’ agendas are parallel and inconsistent with normal human activity. However, it is regular human activity that has been harnessed, by bankers, to fund their parallel civilization and its agendas.

It has been widely known for millennia that giving bankers free and total control of the production and distribution of currency will always result in the wealth and resources of the common man being transferred to the banking system.

We are now at the Point of No Return, where central banking agendas are about destroying the middle class in Western civilization while creating a high technology-controlled feudal system. Many people, myself included, have spent years warning others about the dangers of central banking.

It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning — Henry Ford

I have shown in my previous article a world war is NOT possible without central banks. In our current situation, central bankers are funding what will likely become a world war in Ukraine.

At this moment, the U.S. is creating billions of dollars (theft of American wealth through inflation) to fund a war with money, manpower, and machinery that does nothing for Americans except lower the standard of living and perhaps bring the battle to American soil.

Just like WW1 and WW2, the war in Ukraine is a war of agenda, and that agenda is not consistent with America first or with the needs and welfare of Americans.

War escalation is telegraphed today when the State Department issued a dire warning to people not to travel to Russia and, if Americans are in Russia, to leave now.

In many of my previous articles, I have explained that central bankers plan to destroy the American financial system and middle class. The end result will be to install a new central bank digital currency system that eliminates cash, and all private transactions and places total control of your financial resources in the hands of the bankers.

Point Of No Return

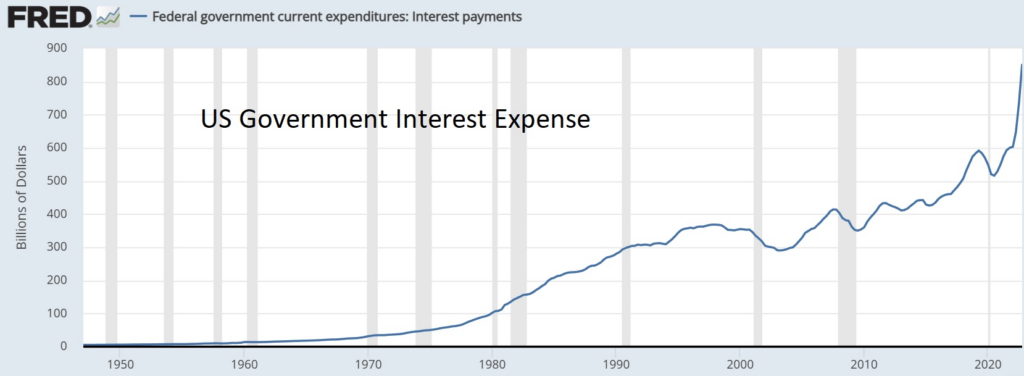

By now, those reading my previous article understand that inflation becomes the symptom of a debt-currency malignancy. When the interest payments on debt already created become a substantial portion of the currency circulating, more debt is required to support the liquidity necessary for private commerce.

At some point, liquidity requirements trigger increases in the amount of new debt that must be created – this becomes a snowballing effect, and inflation will begin to rise exponentially along with debt creation. If the central banks were to attempt to stop inflation by curtailing money creation (debt), the financial system would lock up almost instantly as the debt markets collapse under the pressure of liquidity requirements.

Monitoring the 10-year yield shows us the debt markets are collapsing now.

The situation has gone past the point wherein any curtailment of the money supply can save the financial system from collapse. Therefore, we are witnessing central banks deliberately cause inflation while raising interest rates to hasten the collapse. Raising interest rates curtails middle-class borrowing, but without curtailment of the money supply, there is no possible way to bring inflation down.

The chart below explains at a glance what a mountain of words struggles to convey. Interest payments are going parabolic – the end of a debt-based currency is nigh.

The Signs of Collapse

The material below will shine some light on the various signs of collapse in our economy.

Housing Market

Housing prices are still in a bubble, having risen 43% from 2020 through June of 2022 when the top was reached. Prices are now falling, and typically a housing shake-out takes time; this time is different.

Home prices have fallen for five straight months, the longest stretch of falling house prices since 1986 when the Case Shiller report came into existence.

[…] if we trace history, we can see that this type of decline rarely happens. In fact, since 1986, which is the earliest reading I could find for the Case Shiller DeMorgan has almost never dropped more than 3%. The only exceptions are 2008 and this small 3.05% Drop in 1990.

Then in 2020. We saw the unthinkable occurred, the measurement moves straight up and just kept going and going. The median American who bought a home in 2022 is now paying over 52% of his gross before tax income on the mortgage, we are now well above the relative prices of 2008. And if that was the worst real estate bubble this country has ever seen.

Home builders like Lennar, Toll Brothers, and others are cutting prices of new homes; this will be the push needed for the housing price dominoes to all start falling.

Middle-Class Situation

Inflation rose 0.5% in January, more than expected and up 6.4% from a year ago.

Inflation continues to rise as prices are said to have increased 0.5% in January over December, but I believe these numbers are two low, as we will see when, later, they are revised just like the inflation numbers for the 4th quarter of 2022 were recently revised with November and December coming in higher (long after these lower numbers were presented in the mainstream news feeds.)

Big news! Quiet revisions to US CPI show that Q4 inflation was higher than we thought. Anyone who has been to a grocery store lately already knows this, but these “soft” inflation numbers were repeatedly trumpeted by Wall Street strategists and politicians as proof of their genius. Now it turns out the numbers were off. Specifically, December month-over-month core CPI was adjusted upward from 0.3% to 0.4%, November core CPI was adjusted from 0.2% to 0.3%, October core CPI was unchanged at 0.3%, and some inflation figures from earlier in 2022 and 2021 were revised as well in both directions.

What this means for you and me is that inflation was higher by 1.2% than we were told. This also means that all financial activity following the November and December announcements based on lower inflation was economic decisions made with the wrong information. The rising stock prices of January were partly based on insufficient inflation data.

Democrats push to eliminate the debt ceiling and allow unlimited government borrowing.

Dozens of House Democrats have proposed legislation that would eliminate the debt ceiling, which would allow the government to borrow without any limit set by Congress.

Can you understand what will happen when unelected, globalist-only central bankers successfully remove the debt ceiling restrictions – allowing unlimited borrowing from the American people?

Central bankers are unaccountable, untouchable, and now on their way to achieving the goal of unlimited borrowing for anything and everything they claim they need.

Central bankers have zero national loyalty, and what’s worse is this: central banking funding serves the globalist agenda of eliminating national and sovereign governments and the installation of a one-world government, including a new slave currency to be rolled out in the USA in July called the Central Bank Digital Currency (CBDC).

Telegraphing Dollar Collapse

2022 was record year for central bank gold buying, WGC confirms

Two years on from dropping to its lowest level in a decade, central bank demand for gold has rebounded strongly, with net purchases rising by 1,136 tonnes valued at some $70 billion in 2022, the World Gold Council (WGC) said on Tuesday.

Central bankers, who claim Gold is a Barbarous Relic, are buying record amounts of gold.

Folks, there is only one reason the central bankers are buying gold – because Gold Is Money and Nothing Else

64% of Americans are living paycheck to paycheck

As the cost of living surged in 2022, the number of Americans living paycheck to paycheck jumped to 64% as of December, according to a recent report. Compared with 2021, 9.3 million more Americans said they are stretched too thin.

U.S. credit card debt jumps 18.5% and hits a record $930.6 billion

Baby boomers, 72 million of them, are finding it challenging or impossible to retire.

Do you think the price of oil is going to come down soon? No – the central bank agendas mentioned above demand rising oil prices for those already under the yoke of central banking currencies.

Cost of Shipping Gasoline Jumps 405% After Russia Sanctions

The cost of moving gasoline and other fuels on ocean-going tankers is soaring days after sanctions targeting Russia’s petroleum sales.

I can continue to add more headlines and information about the crash in progress, but I think the above drives home the point.

The dangerous and Constitutionally repugnant central banking system is deliberately destroying the American financial system and middle-class America.

Bank of America Is Preparing for Possible US Debt Default, Says CEO Brian Moynihan

Special Statement On Banks

You may have heard many quotes from people saying that when banks win, they keep the profit, but when they lose, the people pay for the losses. This was shown to be true in the 2008 financial collapse when banks were bailed out to the tune of over $20 trillion dollars – or as we saw in Cyprus when banks began to fail, the bankers reached in and took the deposits of their customers.

Banks are failing now and will transfer their losses to depositors using the contract notion of the “unsecured creditor.” Banking contracts with depositors give them the right to reach into your account and take your money to prevent their losses from closing the bank – this is called a Bail-In.

Furthermore, awake people are now taking their money out of banks to prevent their earnings from being stolen, causing extensive and unpublicized bank runs. Bank runs are a sign that a bank might soon fail.

An example of a mega bank collapsing is the second largest bank in Switzerland, Credit Suisse. This bank has recently suffered enormous losses in share price, making it very difficult for the bank to borrow (raise) capital. Meanwhile, awake depositors are removing their money from the bank (a bank run).

Credit Suisse Craters After “Staggering” Bank Run And Warning Of Continued Losses

The first wave of stock price collapse happened in late 2022, when Credit Suisse stock cratered to never before seen levels after a series of dismal earnings reports and regulatory “missteps” sparked a staggering bank run, amounting to some $88 billion forcing the bank to seek emergency liquidity from the Fed via SNB swap lines, and which also led to a historic corporate restructuring which included the de facto closure of the bank’s investment bank coupled with mass layoffs and bonus cuts, many thought that would be as bad as it gets as the (rapidly changing) management had finally thrown out the kitchen sink.

The next wave came a few days ago when Credit Suisse shares tumbled as much as 12% after the Swiss bank unexpectedly posted a bigger-than-expected loss for the fourth quarter and even more unprecedented client outflows, exacerbating the difficulty for new CEO Ulrich Koerner in returning to profitability by next year.

According to KBW analysts: this was a “quite staggering” level of customer capital outflows which hit a record 110.5 billion francs in the quarter…

The current climate of rising interest rates and steadily rising inflation has put all banks at risk, and bank runs are possible at a moment’s notice.

If you are holding large quantities of your cash resources in a bank, consider moving this money out of your bank. This is not advice, just something to think about.

HUGE Bank Run RIGHT NOW! ( Get Your Money Out Of The Bank )

Silver And Gold Markets

Silver and gold are money. Dollar purchasing power will collapse with rising inflation. Remember, it’s not rising prices but instead the falling purchasing power of the dollar that causes inflation.

Silver and gold will preserve your purchasing power. See my previous articles for more about how and why silver and gold preserve purchasing power.

Right now, silver is the most undervalued asset in the market. Silver is still under the relentless pressure of price manipulation, which costs a large amount of borrowed money to maintain, and its price is ridiculously low – for now.

But shortly, silver will become unavailable at any price. This will happen because supplies are being bought, and silver is used in most electronic devices, such as mobile phones, medical equipment, solar panels, and much more. At that time, silver could make you rich, as small handfuls of silver could be used to purchase cars or even houses.

Silver and gold are on sale now: make sure to take advantage of this sale.

A Commodity SUPER-SPIKE Is Coming. Are You Ready for It?

Bankers preparing for the demise of the dollar: Central Banks Are Buying Gold At The Fastest Pace In 55 Years

Today commodities, in general, are in massive INVERSE bubbles; therefore, when risk-on eventually becomes risk-off, and it will, the price of commodities will SUPER-SPIKE.

Silver demand reached an all-time high in 2022, according to the Silver Institute.

Demand for silver was expected to have reached a new high of 1.21 billion ounces in 2022, up 16 percent from the year before, driven by increases in industrial use, jewelry and silverware offtake, and physical investment.

Mining stocks are beginning to come alive, and giant companies like BHP are reporting record-high earnings and stock prices. Junior mining stocks are at the launch pad and judiciously choosing the right company might be your key to banker independence over the next few years.

Demand for Silver will continue to increase this year.

Silver Spot Price: $21.74 | 1 oz. Silver Eagle Price $35.04 | Premium 61.17%↑

Gold Spot Price: $1839.50 | 1 oz. Gold Eagle Price $2,005.50 | 9.02% ↓

$50 face value junk silver $1081.00 | 38.96% over spot price for 71.5% silver quarters↑

10 Yield: 3.80% ↑[UNSTABLE!]

Crude Oil Price: $77.70 ↓

* note arrows show price increase or decrease over the last article.

Final Comments

Central Banks are dangerous and should be immediately shut down and disbanded. The future for humans if we do not end central banking is bleak.

There is a plan, and it is near completion, to destroy the current paradigm of sovereign nation-states controlled by uncompromised elected governments.

We are close to losing our sovereignty and the rights as enshrined in the United States Constitution.

Some say we need a revolution.

Without revolutionary efforts, we will soon see a CBDC emerge, replacing the dollar and all currencies worldwide. With this idea and other concepts, such as social crediting scores for “good citizens,” we will soon become nameless slaves – numbers and scores but not individuals.

Each of you (and me) must stand against this plan for our future. We must be ready to join any revolution against such plans that might arise.

Make your plans now.

Here are a few things of immediate importance.

Move out of cities.

Convert dollars that will be held hostage in the banking system to silver (and gold).

Keep Enough cash on hand for a month of typical requirements.

Keep stocking up on food.

Purchase productive assets (farms, farmland, tractors, specialized machinery).

Make preparations for gasoline and diesel fuel shortages coming this winter.

Obtain necessary components of cooking – cooking oils, flour, sugar, seasonings, etc.

Learn new skills: fishing, hunting, food storage, and gardening.

Purchase a water purification system.

Invest in solar equipment for power generation.

Consider communications a priority and invest in radio equipment (shortwave receivers, shortwave radios (get your license), GMRS radios.

Please note that the so-called “Junk Silver” is a fantastic way to own fractional silver and carry and use silver in a familiar, safe manner. Please see my new article, What is Junk Silver and Why You Should Buy Some. In this article, I explain how to price and buy “junk silver” and why it is a good idea to get some – oh, and get it soon.

** Ideas and suggestions in this article are my own opinions and are not intended to be financial advice.

Jack Mullen, MBA

* Note I am not giving advice, only my opinion, I am not a financial advisor. This article represents my thoughts about the economy only.

I was wondering what the amount of global total debt: consumer, corporate and governmental, represents vs the actual money in print. The collapse indeed seems to be programmed as to fall into a virtual system controlled by who? The push towards digital currency indicates and allows this.